Recent volatility in U.S. stocks, coupled with global media’s relentless “AI bubble” narrative, has fueled widespread anxiety. Some even compare the current AI frenzy to the infamous dot-com bubble, amplifying fears. But is an AI bubble truly imminent? Let’s break it down.

Key Takeaways:

- 1.The recent U.S. market correction is driven by liquidity—not AI overvaluation. Federal government shutdowns and Fed policy shifts are the real culprits.

- 2.Two prerequisites for an AI bubble: fundamental cracks and liquidity crunch. Neither exists yet.

- 3.The AI bubble debate should begin in mid-2026—at the earliest.

U.S. Market Downturn: A Liquidity Crisis, Not an AI Bubble

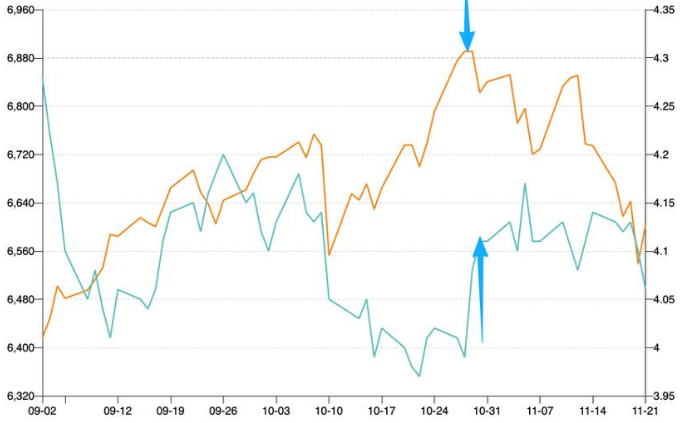

The U.S. stock market typically follows a “stocks vs. bonds” seesaw—capital shifts between equities and fixed income. But the recent sell-off wasn’t just a rotation; it was a “stocks and bonds double whammy” (both asset classes plummeted).From late October to mid-November, 10-year Treasury yields rose sharply (bond prices fell), while stocks tumbled. Investors across the board rushed to deleverage, a classic sign of liquidity scarcity—when markets lack the cash to sustain asset prices.

Phase 1: Government Shutdown (Oct 1 – Nov 12)

The 43-day federal shutdown (the longest since 2019) began when Congress failed to pass a budget due to partisan disputes over healthcare spending. While Treasury bond issuance continued, government spending froze, draining liquidity from financial markets.

- •The U.S. Treasury General Account (TGA) swelled to nearly $1 trillion, sucking cash out of the system.

- •The Fed was still shrinking its balance sheet (quantitative tightening), compounding the liquidity crunch.

- •Result: Bond yields spiked, stocks fell, and risk assets were dumped indiscriminately.

Phase 2: Post-Shutdown Liquidity Panic (Nov 12 – Present)

When the shutdown ended on November 12, the TGA began draining again, briefly boosting liquidity and lifting stocks. But the relief was short-lived.

- •Investor Michael Burry (of The Big Shortfame) shorted Nvidia, claiming AI stocks were wildly overvalued. This spooked markets, sending AI-related stocks tumbling.

- •Yet crypto, gold, and other safe-havens also dropped—unusual if the sell-off were purely AI-driven.

- •The real issue? Fed policy uncertainty. President Trump withheld October CPI data (and hinted at never releasing it again) to pressure the Fed into cutting rates. But Fed Chair Powell signaled no immediate rate cuts, creating market confusion.

Conclusion: The AI “bubble” narrative is a coincidence, not the cause. The downturn was primarily a liquidity crisis, exacerbated by political and monetary policy chaos.

Is the AI Bubble Real? Not in 2025.

Let’s assume the market correction wasn’t about AI—then where are the actual warning signs of a bubble?Historically, bubbles burst when two conditions align:

- 1.Fundamental cracks (e.g., declining revenues, profitability issues).

- 2.Liquidity withdrawal (tightening monetary policy).

1. AI Fundamentals: Still Strong

- •Capital expenditures (CapEx) are high—but manageable.

- •Yes, AI-related spending exceeds dot-com era levels, but today’s tech giants are far more profitable (unlike the money-losing dot-coms).

- •AI CapEx is ~18% of revenue vs. ~33% during the dot-com bubble.

- •No major earnings disasters yet. Unlike the dot-com collapse (triggered by crumbling profits), AI firms remain financially solid.

2. Monetary Policy: Still Loose (for Now)

- •The dot-com bubble burst when the Fed aggressively hiked rates.

- •Today? The Fed is expected to stay dovish—or even ease further.

- •Potential Fed leadership change (Hassett, a Trump ally, may take over) could lead to even looser policy.

- •No immediate signs of a 2000-style rate shock.

What to Watch in 2026

If you’re worried about an AI bubble, monitor these indicators:

Safe-haven assets (gold, crypto): If their prices remain weak, liquidity is still tight.

2026 Fed policy shifts: If Hassett becomes Fed Chair and cuts rates too aggressively, inflation could rebound—forcing a 2026 rate hike cycle, which might finally burst the AI bubble.